April was an interesting month for the cryptocurrency market, characterized by high volatility, new yearly highs and a sharp decline. BeInCrypto looks at the crypto predictions for the upcoming month of June.

The month of May was the first bearish month of the year for the cryptocurrency market. It’s possible that June will bring more of the same.

Below are the biggest crypto predictions for June related to Bitcoin, Ethereum and other popular cryptocurrencies.

Bitcoin (BTC) will fall to $25,000

Bitcoin price broke off a head and shoulders pattern on May 11 (red icon). The head and shoulders pattern is considered a bearish pattern. As a result, the collapse was to be expected.

However, the movement since the eruption has been unusual. Instead of falling sharply, BTC price surged twice and even crossed the pattern’s center line once more on May 30. However, shortly afterwards it sank again.

Therefore, it is possible that the head and shoulders pattern was not valid.

So the next most likely pattern is a descending parallel channel. If this is correct, on May 31st the price was rejected by its resistance line (red symbol), which started the current move down.

The decline could take the price to the channel support line at $25,000. This is also the 0.382 Fib retracement support level when measuring all of the previous upside. So this is a very likely level for a bottom.

The RSI movement also supports this possibility. By using the Relative Strength Index (RSI) as a momentum indicator, traders can determine if a market is overbought or oversold and decide whether to hoard or sell an asset.

When the RSI is above 50 and the trend is up, the bulls have an advantage, but when the reading is below 50, the opposite is true. The indicator is below 50 and falling, which is a sign of a downtrend.

BTC/USDT daily chart. Source: TradingView

While the outlook for both the price action and the RSI is bearish, a daily close above the channel resistance line will invalidate this bearish BTC price prediction. In that case, BTC price could move into the $31,000 resistance area.

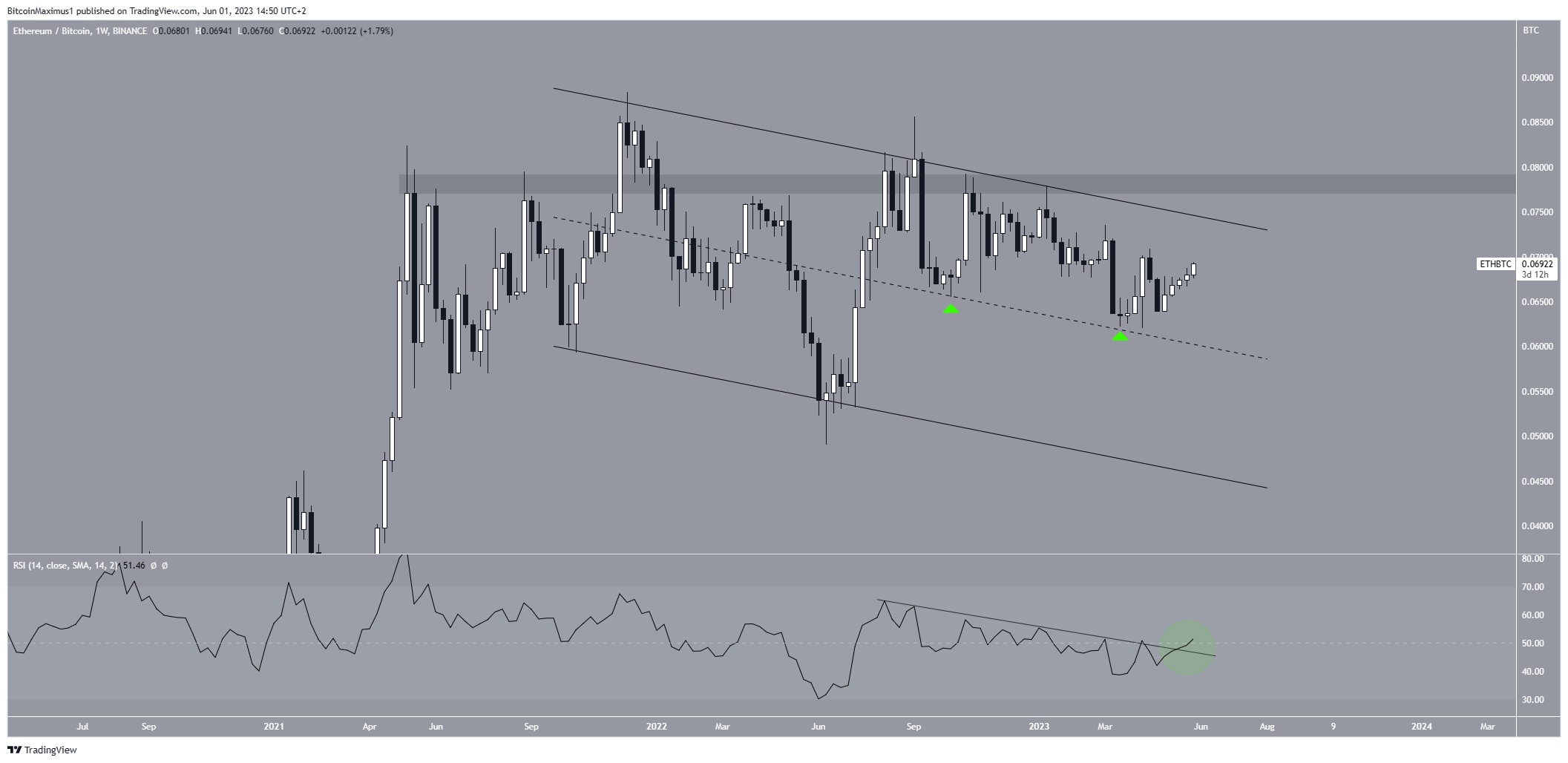

Ethereum (ETH) will make a new yearly high against Bitcoin

Ethereum price outperformed Bitcoin in May. It is likely that this will also be the case in June.

ETH/BTC price has been falling within a parallel descending channel since early 2022. In April 2023, he recovered at the midline of the canal. It was the second time it bounced off that line. As the price is currently floating in the upper part of the channel, a breakout of it is the most likely scenario.

Additionally, the weekly RSI supports the ongoing rise. The indicator broke out of a descending resistance line (black line) and then rose above 50 (green circle).

If the price breaks the resistance line of the channel, it is likely to clear the ₿0.078 resistance area and move towards ₿0.01.

ETH/BTC weekly chart. Source: TradingView

ETH/BTC weekly chart. Source: TradingView

Despite this bullish ETH price prediction, a close below the center line of the channel means that the trend is still down. In that case, ETH price could fall to the channel support line at ₿0.045.

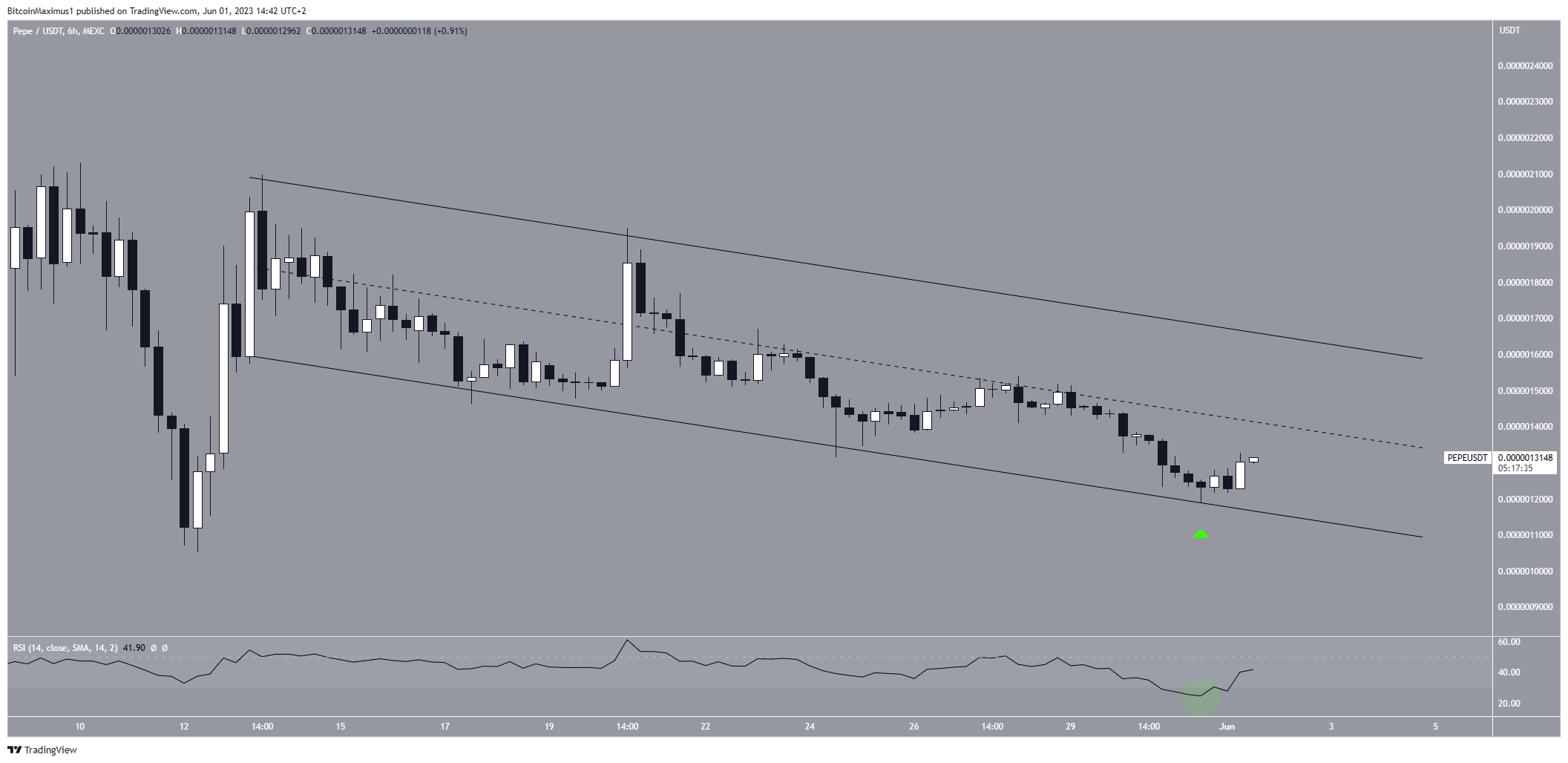

Pepe (PEPE) will start his recovery

PEPE was the top altcoin story in May, emerging as one of the biggest altcoin gainers of all time. However, the price hit its all-time high on May 5 and has fallen sharply since then.

Despite this decline, there should be some recovery in June. There are mutliple reasons for this. The decline since May 13 has been contained in a descending parallel channel.

The channel is considered a corrective pattern, meaning a breakout of it is the most likely scenario.

On May 31, the price rallied at the channel’s support line (green symbol). The surge was accompanied by the lowest-ever RSI reading (green circle). Since then, the indicator has increased.

So, the most likely PEPE price prediction is a rise to the next resistance at $0.0000022.

PEPE/USDT six hour chart. Source: TradingView

PEPE/USDT six hour chart. Source: TradingView

Despite this bullish forecast, a dip below the channel support line means the trend is bearish. In that case, PEPE could continue its long-term decline to $0.0000009.

For BeInCrypto’s latest crypto market analysis, click here

Disclaimer

In accordance with Trust Project guidelines, this price analysis article is for informational purposes only and should not be considered financial or investment advice. BeInCrypto is committed to accurate, unbiased reporting, however, market conditions are subject to change without notice. Always do your own research and consult a professional before making any financial decisions.

Learn Crypto Trading, Yield Farms, Income strategies and more at CrytoAnswers

https://nov.link/cryptoanswers

Comments are closed.