The following is a guest post by Shane Neagle.

Regardless of an asset’s fundamentals, its value is determined by one underlying characteristic – market liquidity. Is it easy for the general public to sell or buy this asset?

If the answer is yes, the asset receives high trading volume. In this case, it is easier to execute trades at different price levels. In turn, a feedback loop is created – more robust price discovery increases investor confidence, which leads to greater market participation.

Since Bitcoin's launch in 2009, it has relied on crypto exchanges to build and expand its market depth. The easier it became to trade Bitcoin worldwide, the easier it was for the BTC price to rise.

For the same reason, BTC price suffers greatly when fiat-to-crypto rails like Mt. Gox or FTX fail. These are just a few obstacles in Bitcoin’s path to legitimacy and adoption.

Bitcoin's Path to Mainstream Finance. Photo credit: Pantera Capital

However, when the Securities and Exchange Commission (SEC) approved eleven spot-traded Bitcoin exchange-traded funds (ETFs) in January 2024, Bitcoin gained a new level of liquidity.

This is a liquidity milestone and a new level of credibility for Bitcoin. Entering the world of regulated exchanges alongside stocks has put an end to critics who question Bitcoin's status as decentralized digital gold.

But what effect will this new market dynamic have in the long term?

The democratization of Bitcoin through ETFs

From the beginning, The novelty of Bitcoin was its weakness and strength. On the one hand, keeping wealth in your head and then being able to transfer that wealth without limits is a monetary revolution.

Bitcoin miners can transfer it without permission, and anyone with internet access can become a miner. No other asset has this property. Even gold, whose relatively limited and inflation-resistant supply can be easily confiscated, as happened in 1933 under Executive Order 6102.

This means that Bitcoin is inherently a democratizing wealth vehicle. But with personal responsibility comes great responsibility and scope for mistakes. Show Glassnode data that around 2.5 million Bitcoins have become inaccessible due to lost seed words that can restore access to the Bitcoin mainnet.

That’s 13.2% of Bitcoin’s fixed supply of 21 million BTC. In fact, self-custody causes fear among both retail and institutional investors. Would fund managers engage in Bitcoin allocation with such risk?

But Bitcoin ETFs have completely changed this dynamic. Investors who want to protect themselves against currency devaluation can now delegate custody to large investment firms. And they, from BlackRock and Fidelity to VanEck, delegate it to select crypto exchanges like Coinbase.

Although this limits Bitcoin's self-custody function, it increases investor confidence. At the same time, miners still make Bitcoin a decentralized asset through proof-of-work, regardless of how much BTC is hoarded in ETFs. And Bitcoin remains both a digital asset and a hard asset based on computing power (hashrate) and energy.

Bitcoin ETFs are changing market dynamics and investor confidence

Since January 11, Bitcoin ETFs have opened the capital floodgates to deepen Bitcoin's market depth, resulting in a cumulative volume of $240 billion. This significant capital inflow has also shifted the break-even price For many investors, it influences their strategies and expectations of future profitability.

However, while the launch was largely successful and exceeded expectations, negative outflows have increased as the Bitcoin ETF hype faded.

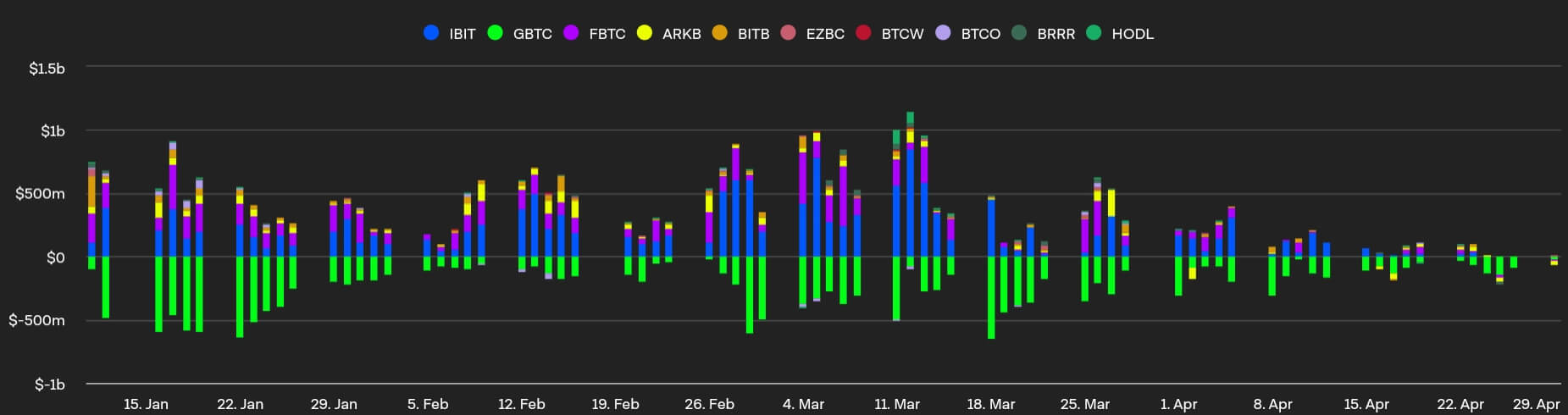

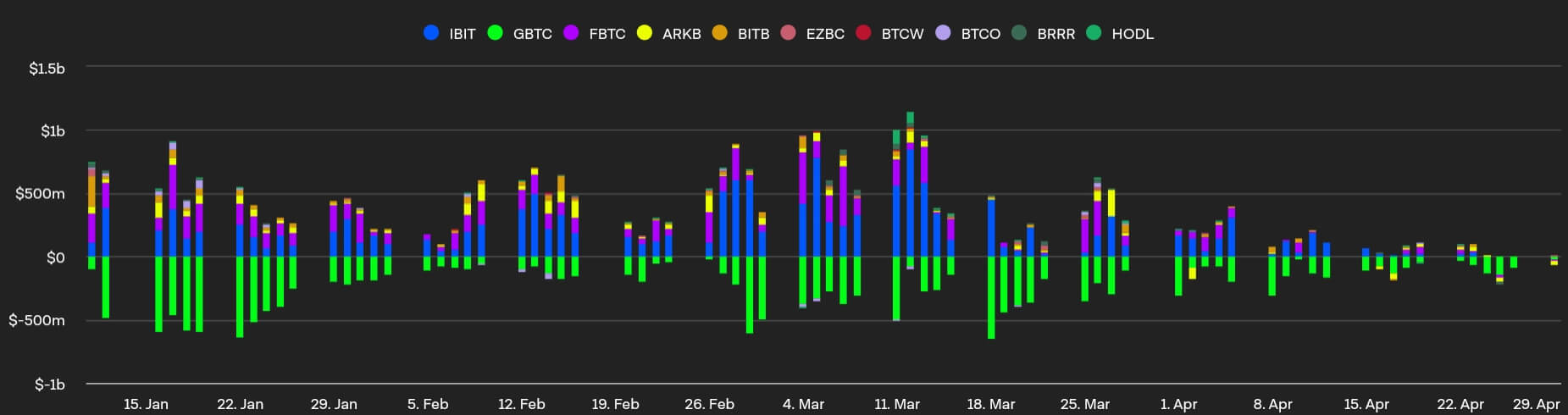

Spot Bitcoin ETF Flows, Image Source: Block

Spot Bitcoin ETF Flows, Image Source: Block

As of April 30, Bitcoin ETF inflows recorded a net negative $162 million, marking the fifth consecutive day of negative outflows. For the first time, Ark's ARKB outflow (yellow) exceeded GBTC (green) by minus $31 million and $25 million, respectively.

Considering that this occurred after Bitcoin's fourth halving, which reduced Bitcoin's inflation rate to 0.85%, it is safe to say that macroeconomic and geopolitical concerns temporarily overshadowed Bitcoin's fundamentals and deepened market depth.

This became even more evident when the launch of Bitcoin ETFs on the Hong Kong Stock Exchange failed to deliver results. Despite opening capital access to Hong Kong investors, volume was only $11 million ($2.5 million in Ether ETFs), compared to the expected $100 million.

In short, crypto ETF debuts in Hong Kong were almost 60 times rarer than in the US. Although Chinese citizens with registered HK companies could participate, investors from mainland China are still prohibited.

Considering that the New York Stock Exchange (NYSE) is about five times larger than the HKSE, it is unlikely that the HKSE's Bitcoin/Ether ETFs will see more than $1 billion in inflows in the first two years said the Bloomberg ETF analyst Eric Balchunas.

Future prospects and potential challenges

During the Bitcoin ETF liquidity explosion, BTC price crossed the threshold above $70,000 several times and reached the new all-time high of $73.7K in mid-March.

However, miners and holders took advantage of this opportunity to build selling pressure and make profits. With sentiment now down to the $60,000 mark, investors will have more opportunities to buy discounted Bitcoin.

Not only is Bitcoin's inflation rate after the fourth halving at 0.85% versus the Fed's 2% USD target, but over 93% of BTC supply has already been mined. The inflow of mined BTC increased from around 900 BTC daily to around 450 BTC daily.

This leads to greater Bitcoin scarcity, and what is scarce tends to become more valuable, especially after Bitcoin investment has been legitimized at the institutional level through Bitcoin ETFs. So much the analysis by Bybit predicts a supply shock on exchanges by the end of 2024. Alex Greene, senior analyst at Blockchain Insights, said:

“The surge in institutional interest has stabilized and dramatically increased demand for Bitcoin. This increase will likely exacerbate shortages and drive prices higher post-halving.”

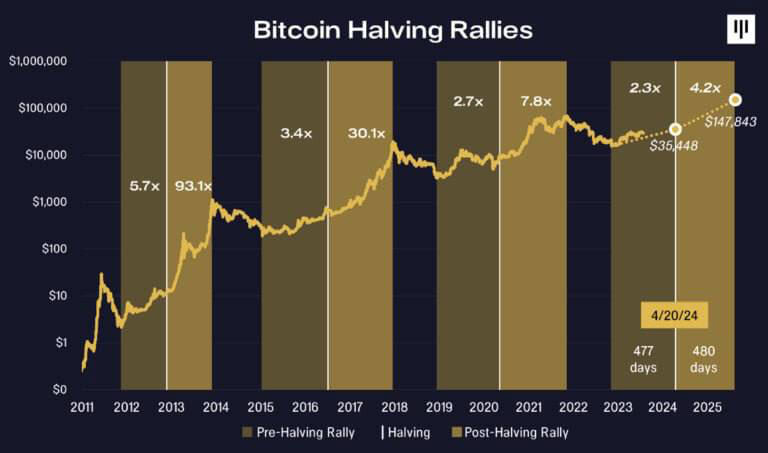

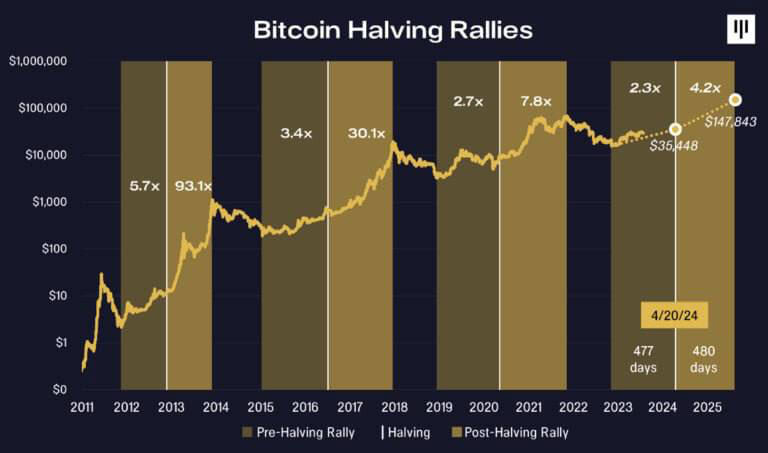

After previous halvings in the absence of the Bitcoin ETF environment, Bitcoin price rose 7.8x in 480 days. Although a higher Bitcoin market cap makes such gains less likely, several appreciation spurts remain on the table.

Photo credit: Pantera Capital

Photo credit: Pantera Capital

However, market volatility can still be expected in the meantime. With Binance situation resolvedAside from leaving behind a series of crypto bankruptcies in 2022, the government remains the primary source of FUD.

Despite Tom Emmer's effortsAccording to the Republican majority, even self-governing wallets could be targeted as money transmitters. The FBI recently hinted at this direction with the warning against the use of “unregistered cryptocurrency transfer services”.

Likewise, the Federal Reserve's interest rate move this year could dampen appetite for risky assets like Bitcoin. Nevertheless, the perception of Bitcoin and the market surrounding it has never been more mature and stable.

If the regulatory system changes course, small businesses could even forgo solutions like… Invoice Financing and switch to a BTC ETF-backed system.

Diploma

After years of rejecting Bitcoin ETFs for spot trading, these investment vehicles built entirely new liquidity bridges. Despite being suppressed by Barry Silbert's Grayscale (GBTC), they have demonstrated strong institutional demand for a value-adding commodity.

With the fourth Bitcoin halving behind us, increasing scarcity and fund manager allocations are now a certainty. In addition, there is a prevailing opinion that fiat currencies will be constantly devalued as long as there is a central bank.

How could governments continue to finance themselves despite huge budget deficits?

This makes Bitcoin all the more attractive in the long run after holders take profits from new ATH points. Between these ups and downs, Bitcoin's bottom will likely continue to rise in the deeper institutional waters.

Mentioned in this article

Learn Crypto Trading, Yield Farms, Income strategies and more at CrytoAnswers

https://nov.link/cryptoanswers

Comments are closed.