KyberSwap announces $ARB token liquidity pools, liquidity drains and trading campaigns on Arbitrum for the first time

Ho Chi Minh City, Vietnam, March 22, 2023, chain wire

Since launching in 2021, Arbitrum has emerged as one of the most promising Layer 2 solutions with its ability to scale Ethereum and enable faster and cheaper transactions.

On March 16, Ethereum’s Layer-2 scaling solution Arbitrum announced plans to distribute a new governance token, $ARB, to its eligible users of the Arbitrum ecosystem as part of its transition, noting that the project will be “as first L2 to launch itself is leading the way -execution governance.”

Expected to go live on March 23, this airdrop is expected to be one of the largest airdrops in crypto history.

KyberSwap was among the protocols whose users bridged to Arbitrum and performed swaps on the platform, thereby qualifying for the $ARB airdrop.

KyberSwap, a leading Decentralized Exchange (DEX) aggregator and liquidity platform, will launch the first-ever $ARB token liquidity pools, liquidity mining and trading campaigns on the Arbitrum chain. These moves mark significant advances for KyberSwap as they will help catalyze significant inflows of liquidity, increasing TVL and creating more earning opportunities in the fast-growing Arbitrum ecosystem.

With the launch of the $ARB liquidity pools, KyberSwap users now have access to more trading pairs and liquidity options. Liquidity providers will also have more opportunities to earn fees and rewards by adding liquidity to $ARB pools and participating in KyberSwap liquidity reduction programs.

The following ARB pools are eligible for Liquidity Mining Bounty:

token pairs

- ARB ETH (2%)

- apr ARB ETH (5%)

- ARB USDT (2%)

- ARB USDT (2%)

- ARB-KNC (5%)

An estimated total of 70,000 KNC were allocated as reward incentives.

*Incentives may continue after the designation period expires; to be confirmed at a later date.

Greater flexibility with new fee levels

With these highly anticipated yield farms, KyberSwap is introducing new fee tiers of 2% and 5%, beating their current highest offering of 1%. These new fee tiers offer $ARB farmers the opportunity to take advantage of the expected high volatility and trading volume during the post-airdrop pricing phase. These pools offer excellent returns on top of farming rewards, and as a liquidity protocol that has been seamlessly integrated by multiple DEXs and aggregators, KyberSwap is well placed to meet full-chain trading needs not found with other competitors.

“We are excited to launch the first-ever $ARB liquidity mining pools,” said Victor Tran, CEO and co-founder of KyberSwap. “These farms mark the start of a massive Arbitrum-centric campaign that KyberSwap has planned, and we’ll be announcing more rewards and activities for LPs and traders soon. Additionally, traders can set their prices to buy or sell $ARB using our limit order feature and trade at the optimized rates using our aggregator.”

Other Arbitrum Yield Farms on KyberSwap

Aside from the upcoming ARB farms, there are other Arbitrum based yield farms available on kyberswap.com:

Depending on the success of the $ARB trade volume, the KyberSwap team is planning additional post-launch rewards for traders and liquidity providers, including $ARB and $KNC airdrops and NFT commemorative rewards.

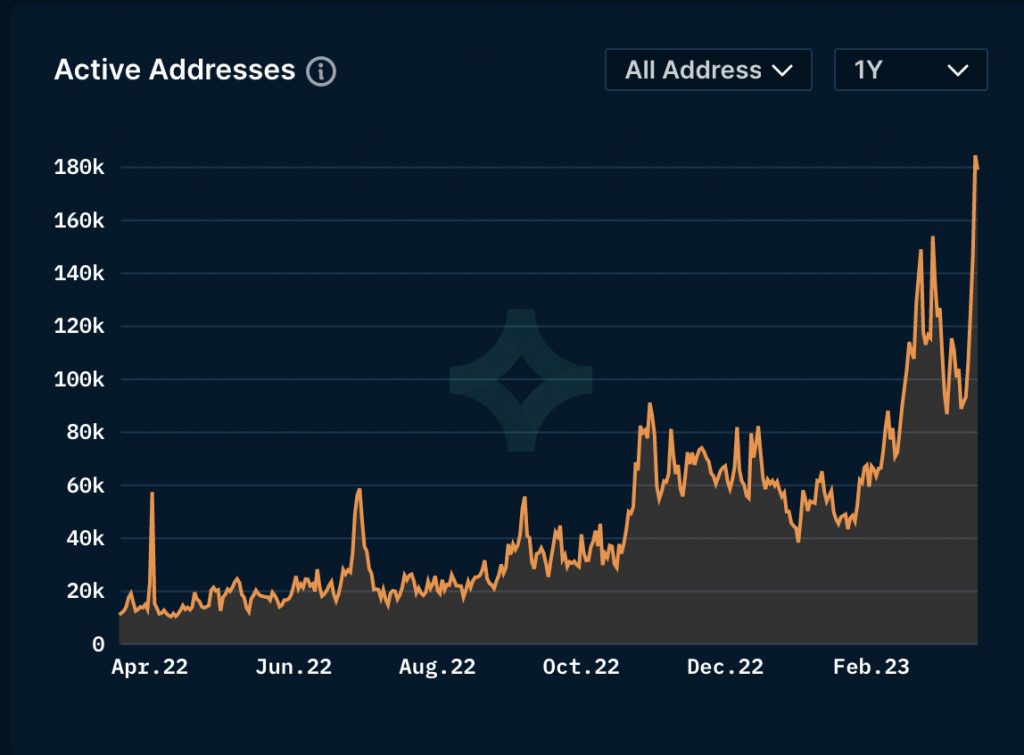

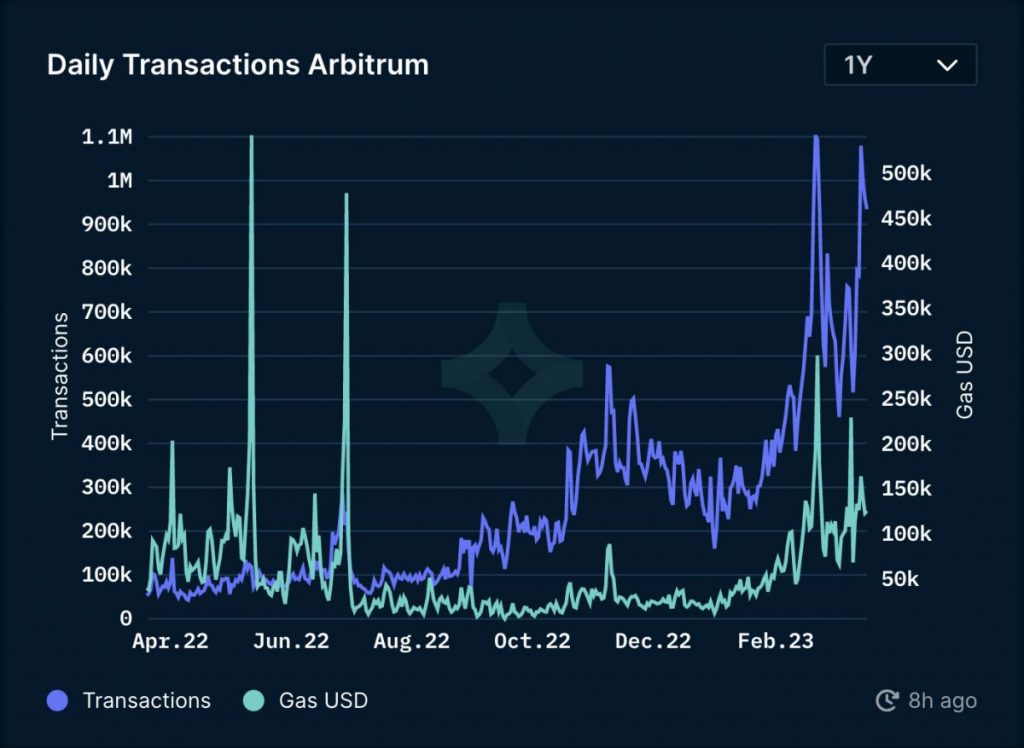

According to Nansen, in 2022 Arbitrum was one of the fastest growing blockchains with more than $1.1 billion in its ecosystem and a rapid increase in transaction volume. This layer-two scaling solution gained massive traction over the year.

![]()

![]()

![]() *Arbitrum Active Addresses/Transactions

*Arbitrum Active Addresses/Transactions

The $ARB token liquidity pools, liquidity mining and trading campaigns will be live on KyberSwap shortly, further details and instructions will be provided on KyberSwap’s Twitter and on kyberswap.com.

About KyberSwap

Kyber Network is building a world to make DeFi accessible, safe and rewarding for users. Their flagship product, KyberSwap, is a next-gen DEX aggregator that offers optimized rates for traders and returns for liquidity providers in DeFi.

For liquidity providers, KyberSwap has a range of capital-efficient protocols designed to optimize rewards. KyberSwap Classic protocol is DeFi’s first market-maker protocol that dynamically adjusts LP fees based on market conditions, while KyberSwap Elastic is a tick-based AMM with concentrated liquidity, adjustable fee tiers, reinvestment curve and other advanced features that purpose-built to give LPs the flexibility and tools to take your earning strategy to the next level without compromising security.

KyberSwap supports more than 100 integrated projects and has facilitated over $15 billion worth of transactions for thousands of users since its inception.

Currently deployed across 13 chains including Ethereum, Polygon, BNB, Avalanche, Fantom, Cronos, Arbitrum, BitTorrent, Velas, Aurora, Oasis, Optimism and Solana, KyberSwap aggregates liquidity from over 80 DEXs to provide users with the best possible rates for their swaps offer .

Contact

marketing specialist

Tanya Heu

CyberSwap

[email protected]

Learn Crypto Trading, Yield Farms, Income strategies and more at CrytoAnswers

https://nov.link/cryptoanswers

*Arbitrum Active Addresses/Transactions

*Arbitrum Active Addresses/Transactions

Comments are closed.