Last update:

April 23, 2024, 5:31 am EDT | 7 min read

Bitcoin halvings are a significant event in the cryptocurrency world. A halving occurs approximately every four years and has a direct impact on the rate of issuance of new Bitcoins. This is how it works:

- The halving mechanism: Bitcoin's block reward halves every 210,000 blocks (roughly every four years). Initially, miners received 50 Bitcoins per block, but after the first halving, this reward dropped to 25 Bitcoins. The May 2020 halving further reduced the reward to 6.25 Bitcoins per block. During the last halving on April 19, the reward dropped to 3,125 Bitcoins per block. The total amount of Bitcoins is limited to 21 million coins, after which no new tokens will be issued.

- Why the halving is important: Halving events are crucial because they directly impact the supply of new Bitcoins. By reducing the rate of issuance, halvings contribute to Bitcoin's scarcity and make it a deflationary asset. This scarcity is one of the factors that contribute to Bitcoin's value.

- Nervousness before the halving: Before the May 2020 halving, Bitcoin experienced a significant price decline in the month leading up to the event. This trend has been observed in several halving events (except the most recent halving in 2024). However, the market tends to react optimistically and expects the positive impact of lower coin issuance.

On the night of April 19th to 20th, the 840,000th block was added to the Bitcoin blockchain, marking the fourth Bitcoin halving. During the halving, Bitcoin price temporarily responded with a slight decline, falling to $63,564 on April 20. At the time of writing, the price has increased slightly to $66,301.

Bitcoin hits record high ahead of halving in 2024

Ahead of the Bitcoin halving in 2024, Bitcoin (BTC) experienced a rally. Since the beginning of the year alone, the price of Bitcoin has increased by 52%, and in the last twelve months it has recorded an impressive increase of 134%. The cryptocurrency reached a temporary peak in its rally on March 13, 2024, reaching a new record high of $73,605.

However, as the Easter weekend approached, buying interest waned slightly. On April 1, the most valuable cryptocurrency was trading at around $69,500. Later in the week, the cryptocurrency recovered and reached $72,572 on April 8, marking its highest level since mid-March.

On April 14, Bitcoin fell below $62,000 as crypto markets reacted sharply to major geopolitical changes. Within just 30 minutes of the official confirmation of Iranian attacks on Israel, Bitcoin lost over 10% of its value. This decline also meant that Bitcoin had lost more than 20% from its recent all-time high.

Ethereum (ETH), the second largest cryptocurrency, also fell by around 10% and fell below the key $3,000 mark.

This weekend, not only cryptocurrencies but also stock markets reacted nervously to Iran's attacks on Israel.

With stock and bond markets closed over the weekend, it was obvious that investors would sell cryptocurrencies if new geopolitical tensions emerged over the weekend. said Jeroen Blokland, founder of Blokland Smart Multi-Asset Fund, on X.

“Bitcoin remains the most volatile asset in the world.”

Understandably, people argue about the hedging properties of #Bitcoin, which remains the most volatile asset on the planet. Even with markets closed over the weekend, what else is there to sell, including in Bitcoin ETFs, as geopolitical tensions rise? https://t.co/zDqQR24NGz

– Jeroen Blokland (@jsblokland) April 13, 2024

The strong price reaction in the crypto markets also has to do with the fact that many crypto investors are leveraged, according to a hedge fund manager explained. This means that in good times the gains are particularly large, but in bad times the losses are particularly pronounced.

Over the next week, Bitcoin's price recovered somewhat and on April 19, the cryptocurrency's valuation reached $66,351 per Bitcoin.

Increasing acceptance of Bitcoin

Bitcoin adoption and recognition has increased significantly this year. The US Securities and Exchange Commission (SEC) approved Bitcoin spot ETFs for the first time at the beginning of the year, making it much easier for many traders to invest in the cryptocurrency.

This development also contributed to the positive movement of BTC price before the halving. Explore Bitcoin ETFs experience March saw a significant increase in trading volume to an impressive $111 billion. This represented a notable increase, almost triple the trading volume reported in February ($42.2 billion).

MARCH MADNESS: Bitcoin ETFs traded at $111 billion in March, about three times the value in February and January. To further explain, I have added the months when only GBTC was on the market. I can't imagine April being any bigger, but who knows… pic.twitter.com/AJEE0mPmpW

— Eric Balchunas (@EricBalchunas) April 2, 2024

Impact of halving 2024 on Bitcoin price

The halving is expected to have a long-term positive impact on the Bitcoin price. Historically, the halving event was usually followed by an upward movement in the price of the cryptocurrency. A look at Bitcoin’s price history on the day of the reward halving and 365 days later confirms this trend.

During the first halving in 2012, BTC price was at $12. A year later it had passed the $1,000 mark. During the 2016 halving, Bitcoin price was at $648 and 365 days later it had climbed to around $2,500. In 2020, during the third halving, Bitcoin price increased by $8,572. A year later, one coin was worth almost $56,000. How high Bitcoin could rise after this year's halving remains uncertain for now.

4th Halving 04/20/2024 00:09 UTC 63,976.64 pic.twitter.com/VJCFHWXPHu

— ChartsBTC (@ChartsBtc) April 20, 2024

Impact on the mining landscape

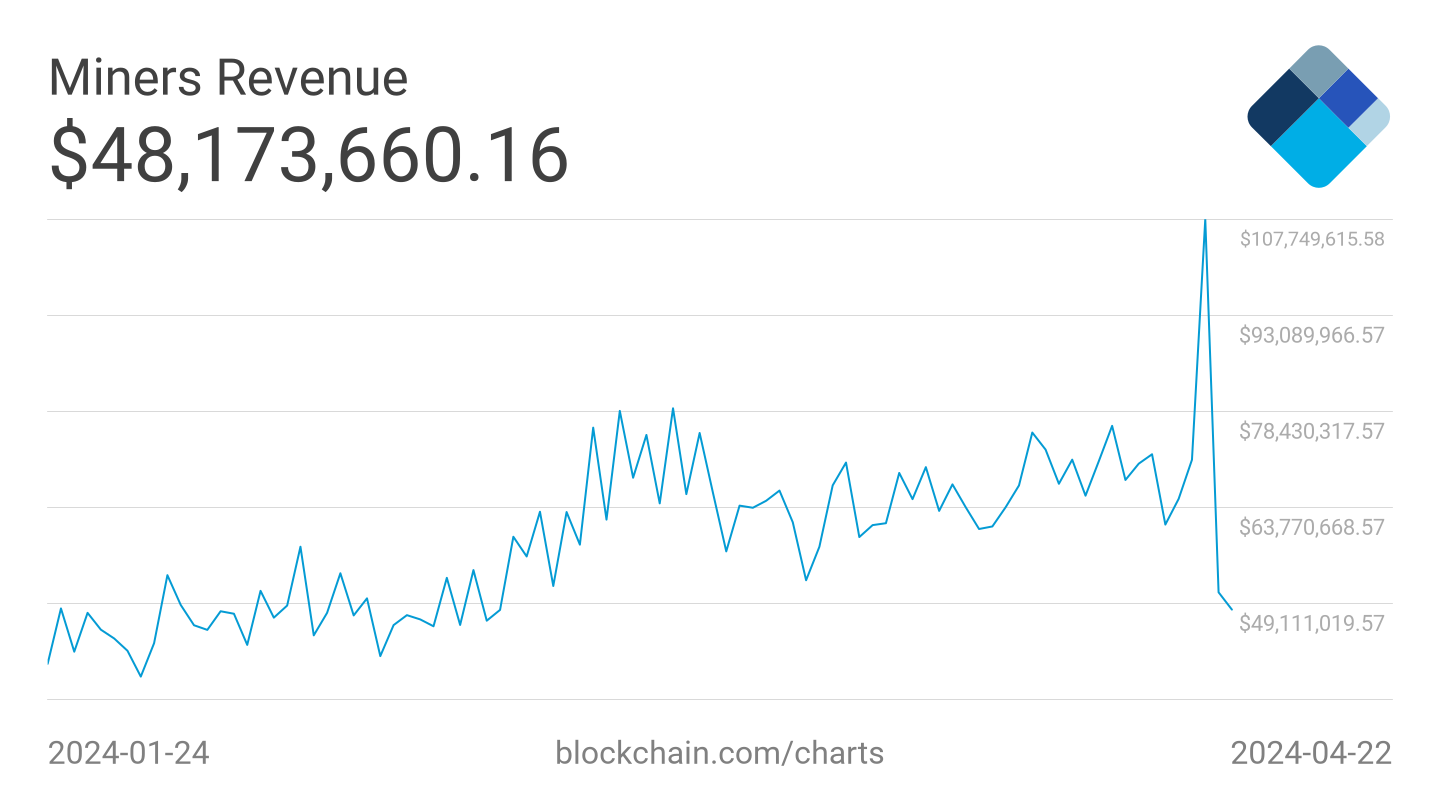

Bitcoin mining revenue exceeded crossed the $100 million mark for the first time and recorded an all-time high daily gain on Bitcoin halving day 2024.

On April 20, Bitcoin miners earned a total of $107.7 million in mining rewards and transaction fees as community members willingly paid exorbitant fees to record their transactions in the 840,000th Bitcoin block.

Total USD value of block rewards and transaction fees paid to miners in the last three months. Source: Blockchain.com

Total USD value of block rewards and transaction fees paid to miners in the last three months. Source: Blockchain.com

In general, the Bitcoin halving in 2024 is expected to have a significant impact on miners, the network and the overall market, primarily due to the electricity costs associated with energy-intensive mining equipment. Miners must adapt to these changing conditions and investors should closely monitor developments at this critical time.

Running mining rigs consumes a significant amount of energy, which is the biggest cost for miners. On average, electricity costs account for 75-85% of a miner's total operating expenses. Currently, the average cost of electricity in the listed universe is about $0.04 per kilowatt hour (kWh).

After the halving, the reward per block dropped from 6.25 BTC to 3.125 BTC. Global investment manager VanEck Estimates His report states that the total cost for the top 10 miners listed will be around $45,000 per Bitcoin. Even as larger miners with lower costs per coin see their profit margins shrink, they should remain profitable, especially if the price of Bitcoin rises.

Halvings often lead to industry consolidation, with smaller miners struggling while larger players expand their market share. According to VanEck's report, publicly traded miners already control a significant percentage of the hash rate.

The next halving is expected in 2028

The next reward halving is expected to take place in 2028. During this halving, the block reward increases from 3.125 to 1.5625 BTC. The aim of the reward reduction is to ensure that the maximum amount of 21 million Bitcoins is not reached too quickly.

In addition, the halving is intended to prevent price inflation, as the supply of available coins increases more slowly while demand remains the same or even increases. Bitcoin’s inflation rate after the last halving is estimated to be around 0.84%. It is currently assumed that the last Bitcoin will be mined in 2140. However, there are still 25 more halvings pending before then.

Bitcoin price predictions

Various crypto experts have already predicted how Bitcoin could develop after the halving event. Youwei Yang, chief economist at Bitcoin mining company BIT Mining, believes Bitcoin could reach $75,000 within the year reported from CNBC.

Meanwhile, cryptocurrency exchange CoinShares believes an increase to $80,000 is possible.

Antoni Trenchev, co-founder of cryptocurrency exchange Nexo, even believes that Bitcoin will reach the $100,000 mark, a sentiment divided from Standard Chartered.

Jurrien Timmer, Director of Global Macro at Fidelity Investments, thinks The value of a single Bitcoin could reach $1 billion by 2038-2040.

But that's not all the optimistic forecasts: the analysis company Matrixport believes that the Bitcoin price could rise to $125,000 by the end of the year.

Venture capitalist Tim Draper sees Potential for $250,000. CoinFund's Seth Ginns is perhaps the most optimistic. He has a “reasonable expectation” that the cryptocurrency could achieve a price between $250,000 and $500,000 in 2024.

However, he also thinks a price of one million US dollars per coin is conceivable “in this next cycle”.In summary, Bitcoin halvings have had a positive impact on Bitcoin price in the past and many experts believe that this trend will continue in the future and the price may potentially reach new all-time highs.

However, it is also important to consider a broader context, including adoption, regulation, macroeconomic conditions, and technological advancements when predicting Bitcoin's future price movements.

A comprehensive Bitcoin price prediction:

Learn Crypto Trading, Yield Farms, Income strategies and more at CrytoAnswers

https://nov.link/cryptoanswers

Comments are closed.