Last update:

April 30, 2024, 6:37 p.m. EDT | 5 minutes read

Bitcoin Price Falls Below $60,000 as ETF/Macro Headwinds Mount – Is the BTC Bull Market Over? / Source: Cryptonews

Bitcoin Price Falls Below $60,000 as ETF/Macro Headwinds Mount – Is the BTC Bull Market Over? / Source: Cryptonews

Bitcoin (BTC) price fell more than 5% to below $60,000 on Tuesday after a disappointing first day of spot Bitcoin ETF trading in Hong Kong and new U.S. economic data pointed to stubborn inflation and strengthening the argument that the Fed should wait before cutting interest rates.

After rising almost to $65,000 in early Asian trading, Bitcoin last changed hands around $60,000.

As macro/fundamental headwinds increase, technical analysis suggests that BTC could be heading for a short-term correction into the $50,000 level.

Since mid-April, Bitcoin price has continuously faced resistance at its 21 and 50 DMAs, suggesting that bears are in control.

Additionally, Bitcoin price has also formed a descending triangle in recent weeks, which typically forms before bearish breakouts.

Should Bitcoin price break south of its recent range low at $60,000, a quick retest of $53,000 is possible. Source: TradingView

Should Bitcoin price break south of its recent range low at $60,000, a quick retest of $53,000 is possible. Source: TradingView

Should Bitcoin break south of its recent range low at $60,000, a quick retest of $53,000 is possible, representing a short-term decline of 12% from current levels.

That would bring Bitcoin price's decline from its March all-time high near $74,000 to nearly 30%.

Spot Bitcoin/Ether ETF launch fails in Hong Kong

The launch of spot Bitcoin and Ether ETFs in Hong Kong on Tuesday was stagnant.

Hong Kong ETF providers had raised eyebrows ahead of the launch, claiming that the Hong Kong launch could outperform the US launch.

Instead, total trading volume was just under $12.5 million, according to Bloomberg data distributed on X.

Hong Kong crypto ETFs were forecast to see $300 million in inflows on the first day.

Instead, they had a total trading volume of $12.4 million. pic.twitter.com/YUGgD6ugjh

– wallstreetbets (@wallstreetbets) April 30, 2024

The launch in Hong Kong was a big disappointment for the market. It was no wonder that the price of Bitcoin saw a significant drop following the release of these numbers.

The weak ETF debut in Hong Kong comes amid a slowdown in inflows into spot Bitcoin ETFs in the US.

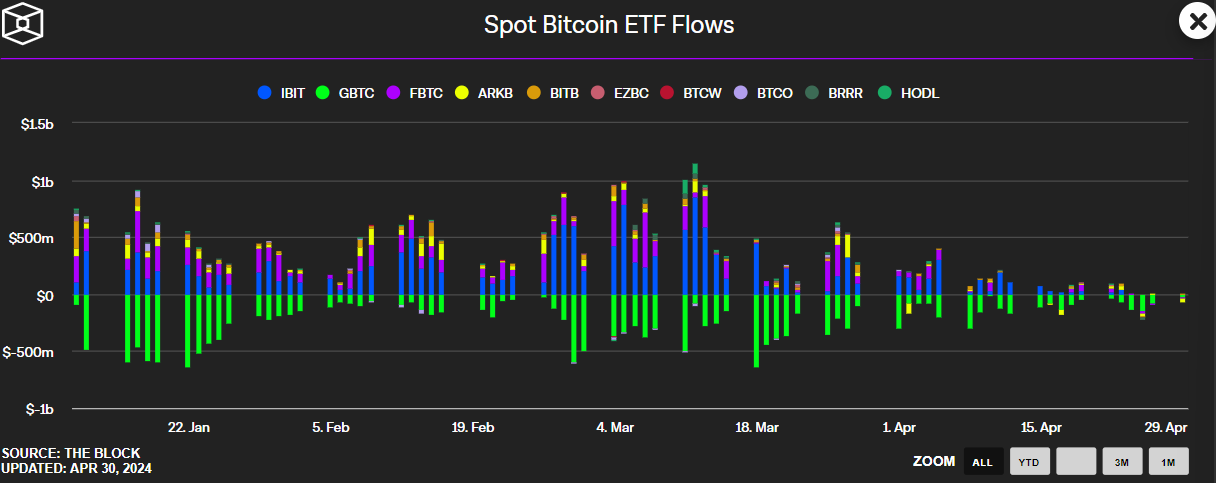

The block data shows that flows have been negative since last Wednesday.

Data from The Block shows flows have been net negative since last Wednesday.

Data from The Block shows flows have been net negative since last Wednesday.

Still, the availability of these ETFs in one of the world's largest financial centers is a major milestone for crypto.

Macroeconomic headwinds continue to increase

Ongoing macro headwinds have added to selling pressure sparked by the weak ETF debut in Hong Kong.

US employment cost inflation data came in higher than expected for the first quarter.

Sticky core inflation…

The U.S. employment cost index rose 1.2% in the first quarter of 2024, accelerating from a 0.9% rise in the previous three-month period and beating the market consensus of 1% growth.

Employment costs have risen the most in a year as wages and… pic.twitter.com/SId678qKuT

— Ayesha Tariq, CFA (@AyeshaTariq) April 30, 2024

The news has raised concerns that U.S. inflation will remain “firmly” above the Fed’s 2.0% target.

According to CME data, the market-implied probability of no rate cuts by September is 50%, compared with 6.5% a month ago.

Meanwhile, the probability of no rate cuts this year has risen to 25%, up from 1% a month ago.

According to Bank of America (BoA), the Fed is in “wait-and-see mode until it has more clarity on inflation.”

❖ Powell feels “pleased” with reassessment of Fed expectations: Bank of America

The main message from the Fed after tomorrow's rate decision may be that “policy needs more time, the next step is most likely a rate cut and the committee will wait until…”

— *Walter Bloomberg (@DeItaone) April 30, 2024

“We suspect Powell is comfortable with the significant pricing of cuts this year,” Walter Bloomberg quoted the BoA as saying.

Respected Fed analyst Nick Timiraos also argued in a recent WSJ article that the Fed will signal “that it has the guts to keep interest rates high for longer.”

Not surprisingly, the US Dollar Index and US Treasury yields are trading near recent highs.

The DXY rebounded above 106 on Tuesday and is aiming for a yearly high of 106.50. The 10-year US bond was last at 4.68% and is looking at a retest of last week's annual highs of 4.74%.

In an environment of tightening financial conditions (i.e. when the market expects higher interest rates and the dollar and yields rise), Bitcoin tends to perform poorly.

Is the Bitcoin bull market over?

Weak ETF inflows, tightening financial conditions and bearish technicals could push Bitcoin towards $50,000 in an immediate manner.

Would this mark the end of the Bitcoin bull market that began in late 2022?

While there will undoubtedly be a lot of FUD on social media platforms like X, that is very unlikely.

Assuming Bitcoin follows its usual four-year cycle, the bull market still has 1.5 years left.

This argument is strengthened by the recent passage of the Bitcoin halving, which has been a key driver of the past four-year cycles.

The first three Bitcoin halvings were all preceded by huge rallies to new record highs, although only after at least four to six months.

#BTC

Don't let this regression distract you from where we are in the Bitcoin cycle$BTC #BitcoinHalving #Bitcoin pic.twitter.com/LniRS6xu8u

— Rekt Capital (@rektcapital) April 30, 2024

The question is whether the price action will be different after the halving.

The price movement leading up to the last halving was different. Bitcoin was able to reach a new all-time high for the first time before the halving, which arguably increases the risk of a post-halving correction that appears to be currently manifesting.

However, that doesn't mean we won't see new all-time highs after the halving in late 2024 or 2025.

And the upcoming easier financial conditions should ultimately provide a tailwind for the market.

The risks are likely to lean more towards US economic weakness and lower inflation than strength.

After all, interest rates are at their highest level in several decades and the yield curve has been inverted for well over a year.

If the US economy were to weaken and inflation fell more quickly, this would accelerate interest rate cuts.

ETF and safe haven demand should boost BTC?

Other factors are also likely to boost BTC. Most potential buyers of US ETFs have yet to enter the market.

Many need to conduct due diligence on new products before investing. Many others do not yet have access because the ETFs are not yet offered by their bank/wirehouse.

The risks are strongly towards a continuation of inflows in the coming years. That means it is very unlikely that the current AUM in spot Bitcoin ETFs will stop increasing.

More broadly, the narrative of Bitcoin as “digital gold” will continue to gain momentum in the coming years.

BlackRock CEO Larry Fink literally joins the host on Fox Business to discuss why #Bitcoin is the modern digital gold, how it protects you from inflation, and eliminates the counterparty risk associated with governments.

The narrative is changing! 🤯pic.twitter.com/OOSAs4eHjt

– The Bitcoin Therapist (@TheBTCTherapist) March 9, 2024

As Wall Street increases its allocation, more companies and countries are likely to adopt it as a reserve asset.

Bitcoin could also continue to attract safe-haven demand if geopolitical/financial stability concerns resurface.

The Fed's interest rate hikes have put a lot of strain on many regional US banks and problems could arise again at any time.

Traders will remember the Bitcoin price surge in March 2023 when various banks collapsed.

Learn Crypto Trading, Yield Farms, Income strategies and more at CrytoAnswers

https://nov.link/cryptoanswers

Comments are closed.