Vladislav Sopov

Bitcoin (BTC) hasn’t been that stable since mid-November 2020; What does this mean for traders?

contents

- Bitcoin volatility is targeting new lows: check the data

- “Extreme fear” still dominates the market as BTC surges above $39,000

Bitcoin (BTC), the flagship cryptocurrency, is still failing to break out of its bearish channel that started in November 2021. At the same time, its volatility is hitting one local low after another.

Bitcoin volatility is targeting new lows: check the data

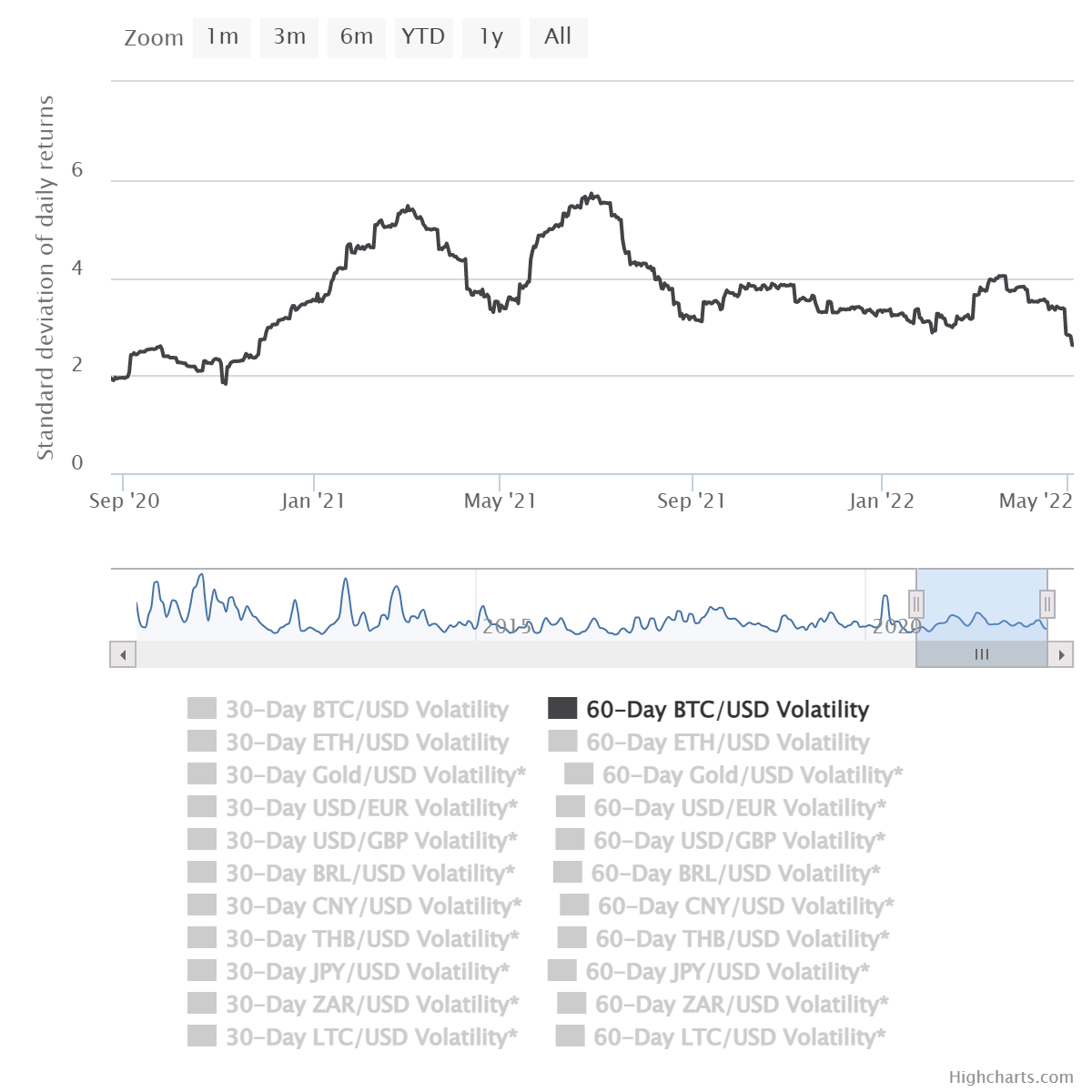

According to the Buy Bitcoin Worldwide portal, Bitcoin’s historical volatility is at an 18-month low. Its estimated 60-day moving average dropped to 2.62%.

Image of Buy Bitcoin Worldwide

Image of Buy Bitcoin Worldwide

The last time Bitcoin (BTC) volatility was this low was in November 2020, when the orange coin scaled above $10,000 for the first time in this bullish cycle.

The 30-day volatility hit a local low on April 27, 2022, but is now showing signs of recovery.

To sue

Similar to VIX for the stock market, the Bitcoin Volatility Index (BVOL) shows how much Bitcoin’s price fluctuates relative to its price on any given day.

The last spike in Bitcoin (BTC) volatility was recorded in July 2021: over the 30-day period, the flagship crypto was twice as volatile as it is now.

“Extreme fear” still dominates the market as BTC surges above $39,000

Meanwhile, Bitcoin (BTC) has started to rally after hitting the local low of $37,400. The flagship cryptocurrency rallied to $39,100 after April’s worst-ever bearish day.

However, traders are not so enthusiastic about this pale recovery. Alternative’s Crypto Fear and Greed Index is 21/100, which means “Extreme Fear”.

This level is very low: In the bearish year of 2022, Bitcoin sentiment fell into the “10-20” zone only twice in January.

Learn Crypto Trading, Yield Farms, Income strategies and more at CrytoAnswers

https://nov.link/cryptoanswers

Comments are closed.