- Prudent Bitcoin traders may want to stay on the sidelines rather than bid.

- A drop below the local low could result in a price drop of almost 15%.

Bitcoin [BTC] fell 7.46% from the local peak reached on April 30. At press time, the transaction price was just above $59.9K, within the $59.2K-$61K demand zone.

Source: BTC/USD, TradingView

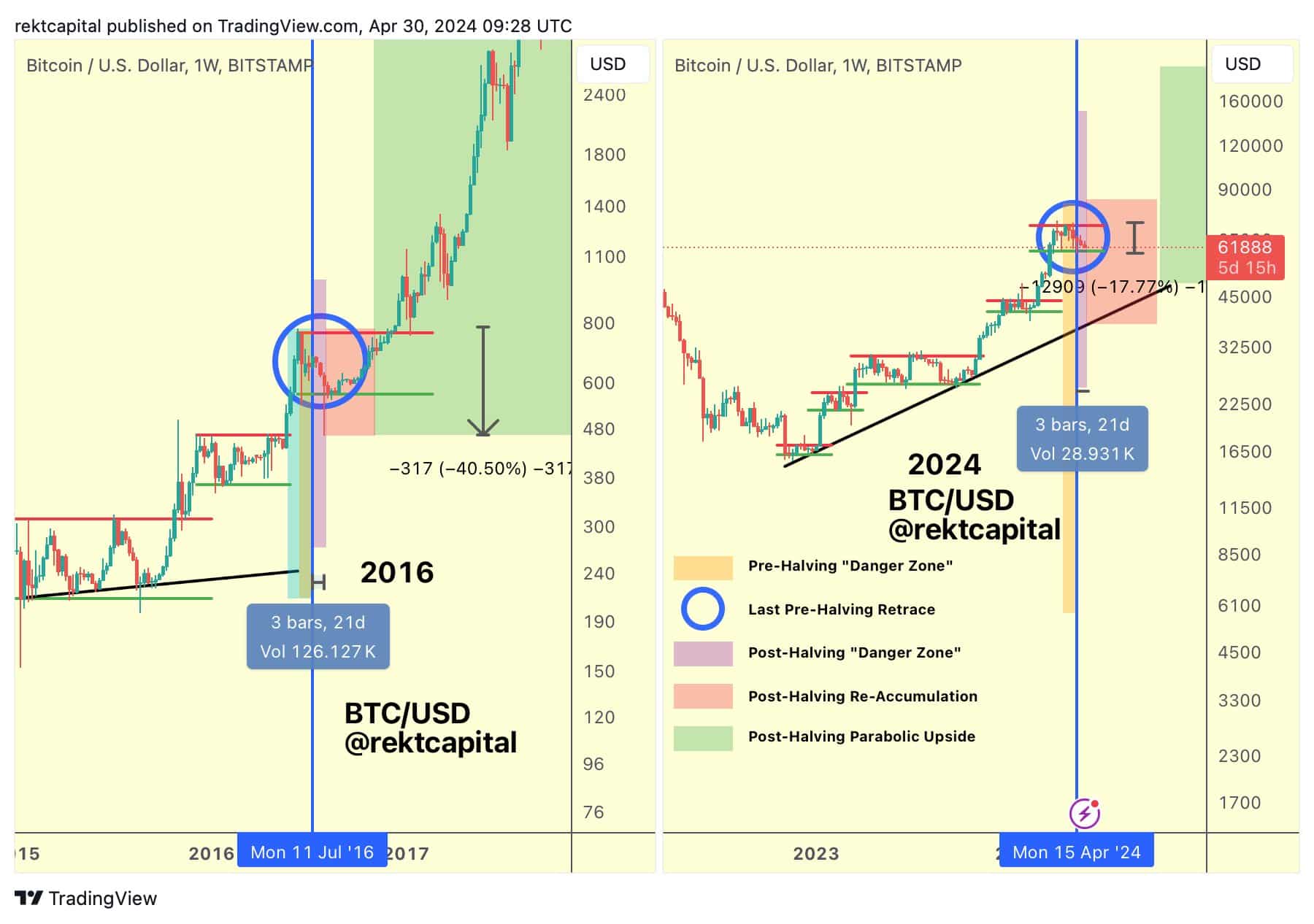

However, according to crypto analyst Rekt Capital, Bitcoin is not out of the danger zone yet.

The analyst compared the current Bitcoin price movement to what happened in the 2020 and 2016 cycles immediately after the halving. While history may not exactly repeat itself, it certainly rhymes.

Are we almost at the bottom?

Source: RektCapital on X

The price performance in 2024 after the halving was more similar to 2016 than 2020, RektCapital claimed. At that time, there was an 11% wick drop 21 days after the halving.

If the same thing happens again, we could expect the BTC price to drop to $52,000.

The $60,000 area has been a technically solid support zone for the past two months. However, each new test of support weakens it. This could be the wave that breaks it.

Until then, buyers may try to buy on dips.

The tightrope is difficult to walk, and most traders may prefer to stay on the sidelines and wait for a positive reaction or a drop below $59,000 to enter a short position.

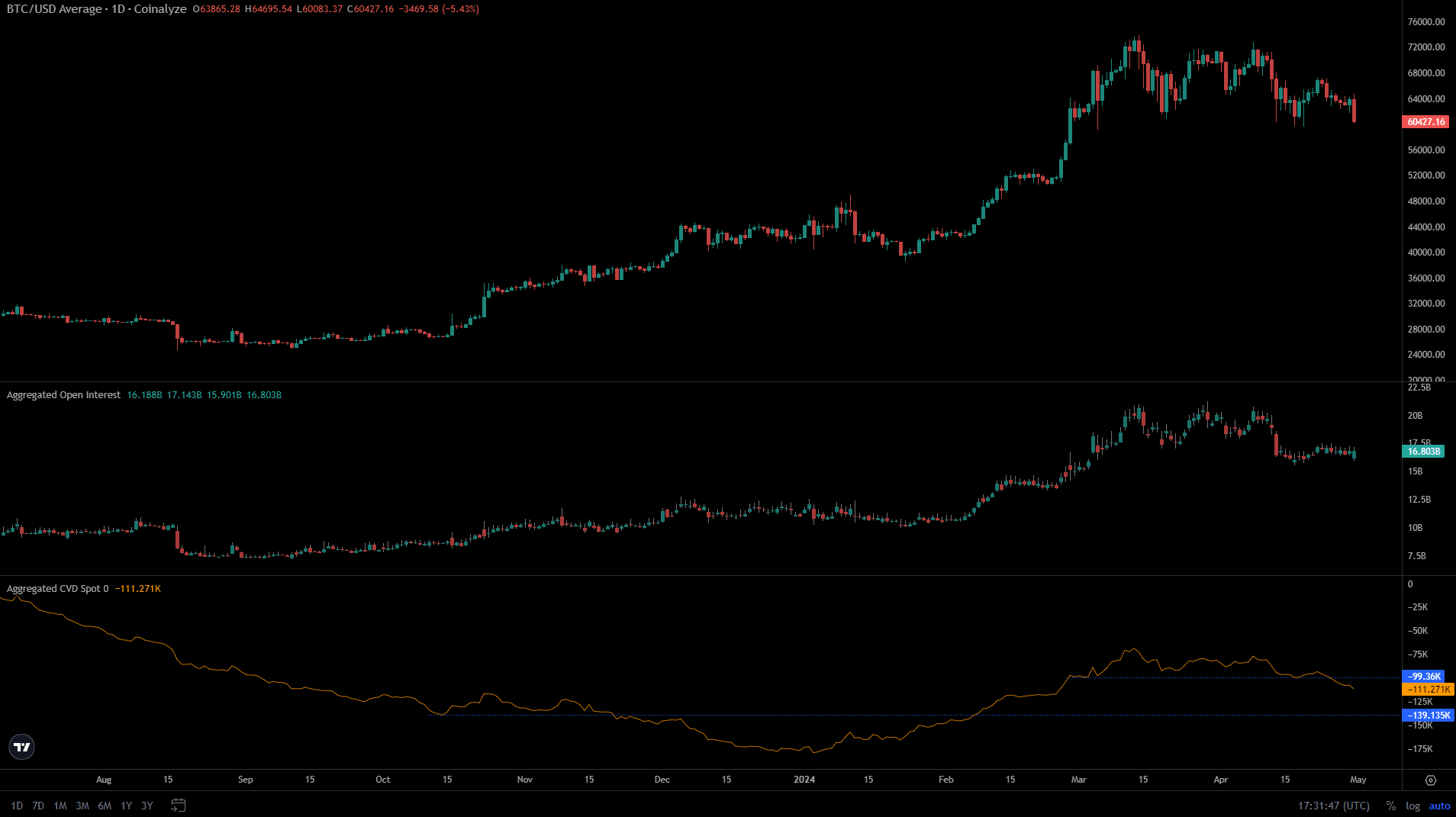

Source: Coinalyze

The spot CVD gave investors cause for concern. It has been in a downtrend since mid-March and has fallen below a support level that lasted until the end of February.

This confirmed HTF’s bearish strength and reduced the likelihood of a further rally from the $60,000 demand zone. Open interest was also declining, indicating bearish sentiment.

Here's why this retracement is healthy in the long term

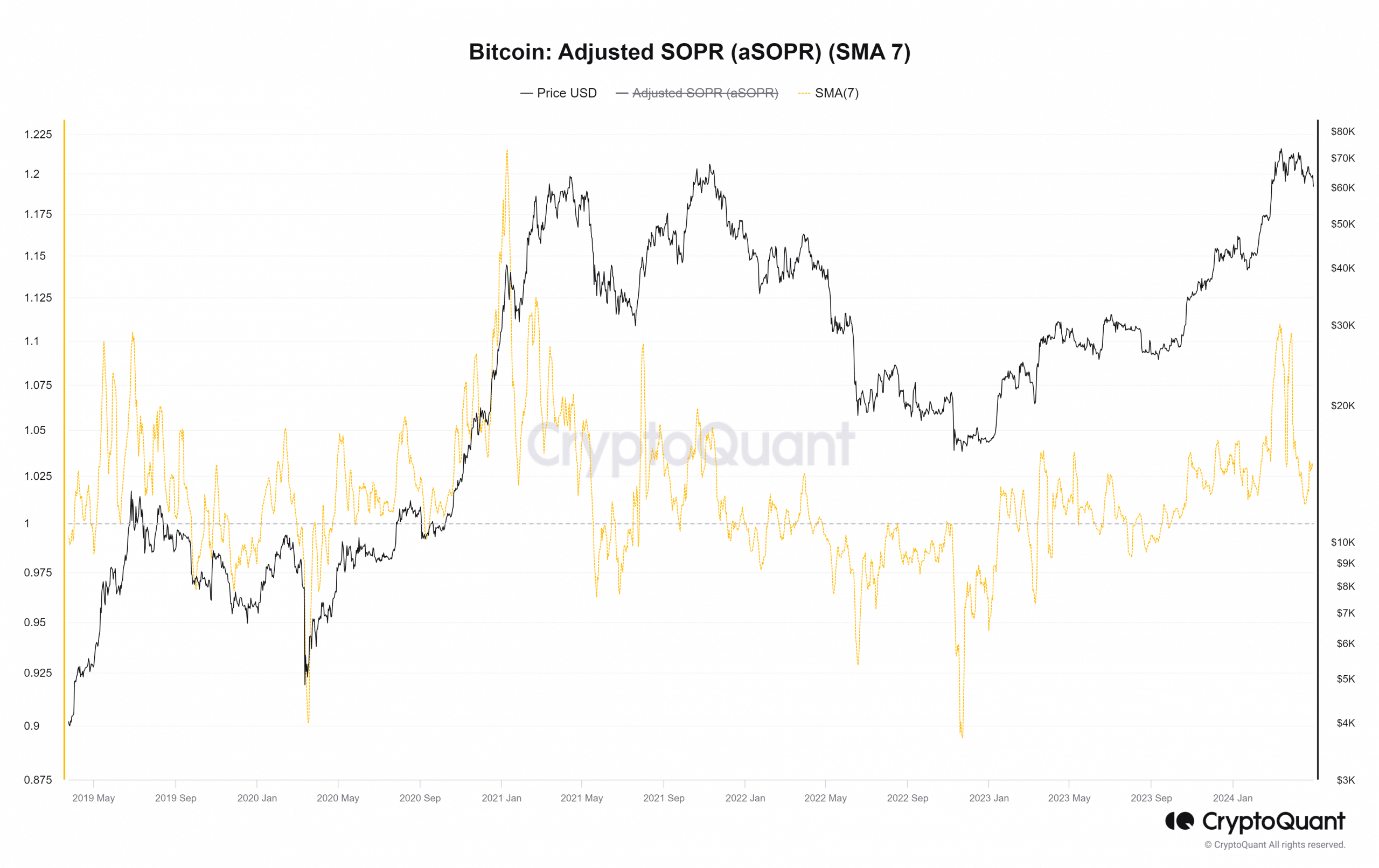

Source: CryptoQuant

The adjusted production profit ratio (aSOPR) saw a massive increase to 1.1 a month ago, but has fallen to 1.029 at press time. A similar scenario played out in May and August 2020.

After overzealous bulls were forced to deleverage, the market saw a more sustained recovery, supported by spot demand.

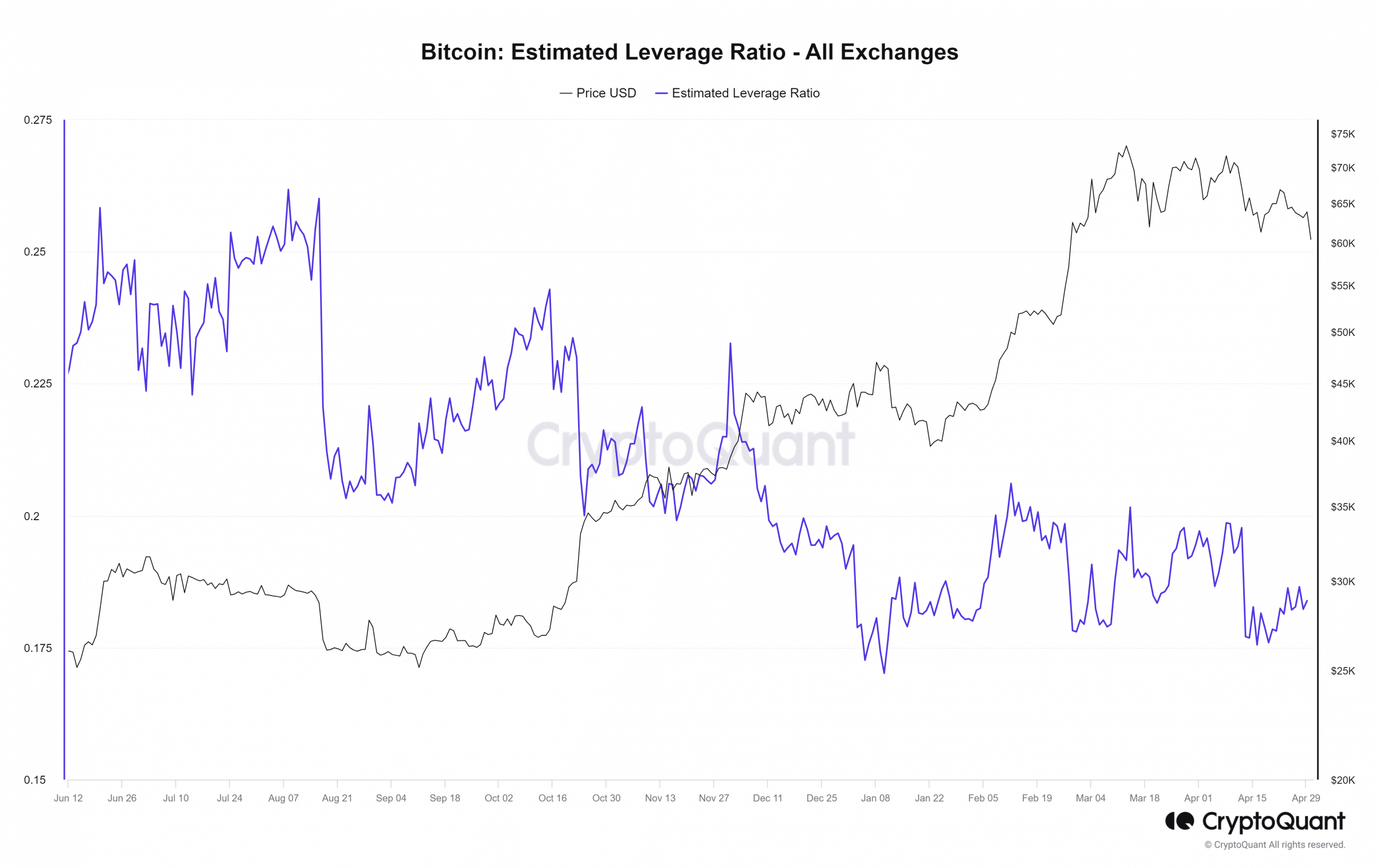

Source: CryptoQuant

Is your portfolio green? Check out the BTC profit calculator

The estimated debt ratio jumped above 0.18 several times in 2024, but had to fall back again. This showed that overleveraged positions were largely wiped out by the recent decline.

However, this does not mean that BTC will see a positive price reaction. A move below the $59.4K level will likely result in prices falling to the $55K and $52K support zones.

Learn Crypto Trading, Yield Farms, Income strategies and more at CrytoAnswers

https://nov.link/cryptoanswers

Comments are closed.