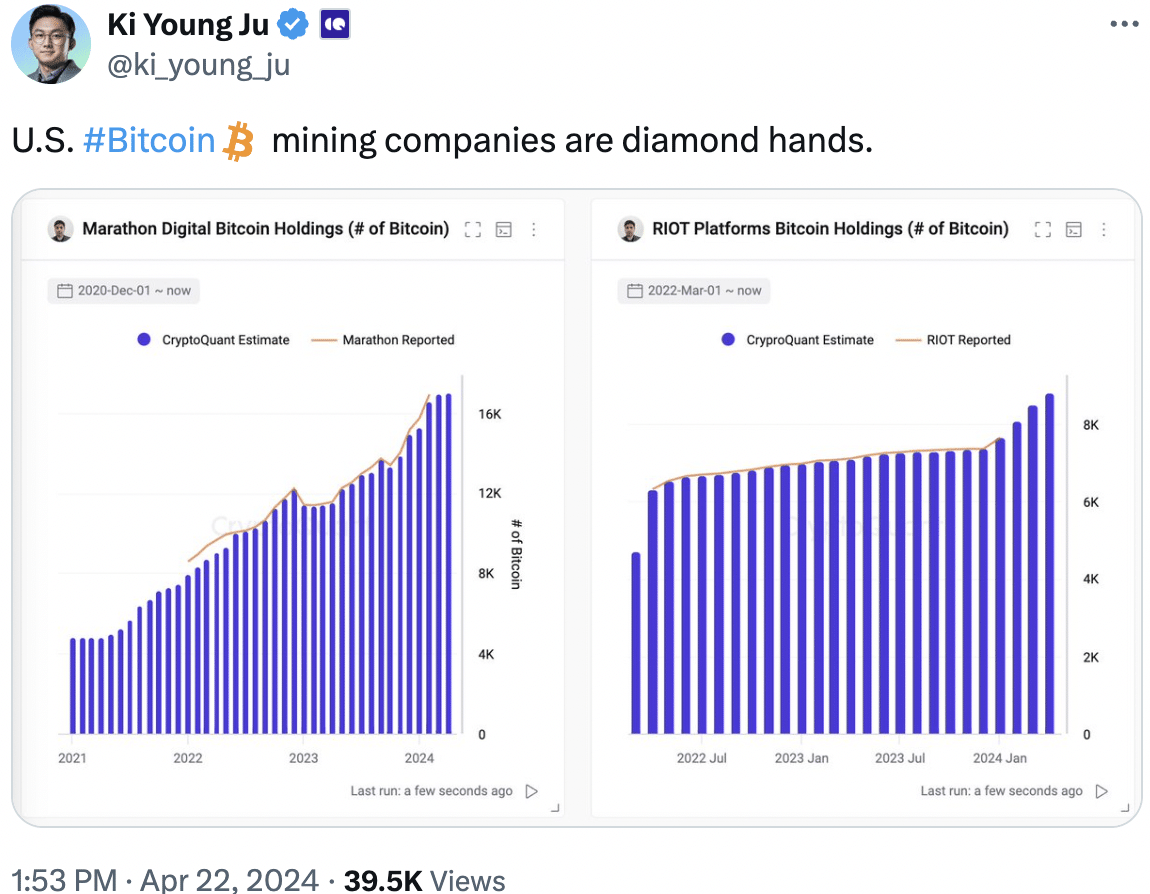

- Bitcoin miners continue to hold on to their BTC despite market volatility.

- Interest in Bitcoin ETFs is declining.

Despite the volatility that Bitcoin faces [BTC] In recent months, some mining companies have shown resilience in the face of uncertainty.

Miners remain

According to new data, US Bitcoin mining companies held diamonds and refused to sell any of their BTC. This indicated that sentiment among most mining companies was positive and they will not be selling their shares any time soon.

This meant that selling pressure on Bitcoin would decrease in the future.

Source: X

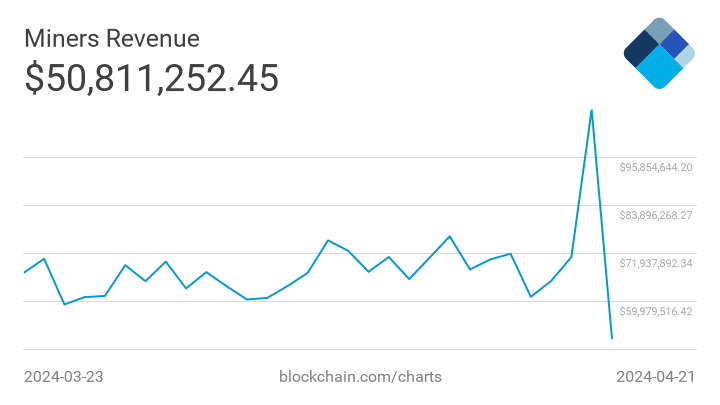

In addition, miners' income also increased significantly during this period, due to the increasing interest in runes. At the same time, the hashrate for BTC also grew.

A rising hashrate for Bitcoin means the network is more secure but also more competitive for miners. You will need more powerful equipment and may face lower individual profits.

Source: Blockchain

Despite these positive factors, there have been some issues that could weigh on the Bitcoin ecosystem.

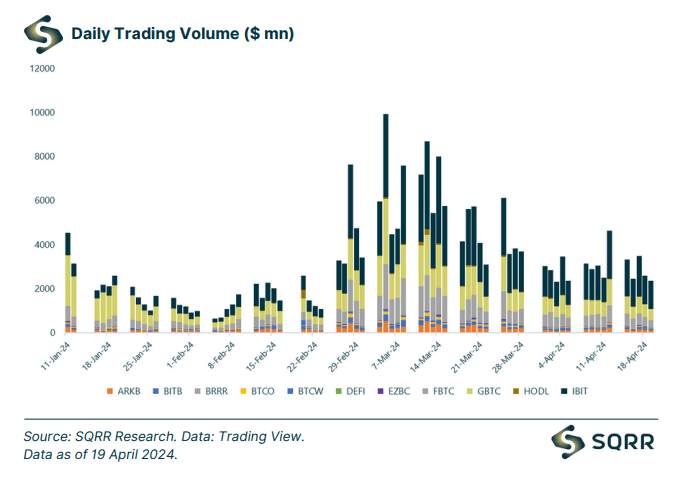

ETF hype is fading

Recent data highlighted trends in Bitcoin exchange traded funds (ETFs) over the past week. We have seen a significant shift towards net outflows, with a total of $319 million flowing out of all Bitcoin ETFs.

Grayscale’s Bitcoin Investment Trust (GBTC) was a key driver of this decline.

In contrast, inflows into ETFs had previously peaked at $12.7 billion but now appear to have plateaued. This suggests a possible cooling in investor sentiment towards BTC ETFs.

Additionally, the data suggests a decline in the trading activity of these funds. Weekly trading volume is down 12% compared to the previous week. This could be a sign of increased investor caution or a wait-and-see attitude ahead of the upcoming Bitcoin halving.

Finally, the total assets under management (AUM) for BTC ETFs has also fallen.

Current AUM stands at $53 billion, down 10% from the previous week. This is consistent with the trend of net outflows and may indicate a decline in investors' overall Bitcoin holdings across these ETFs.

Source: SQRR.xyz

Read Bitcoins [BTC] Price prediction 2024-25

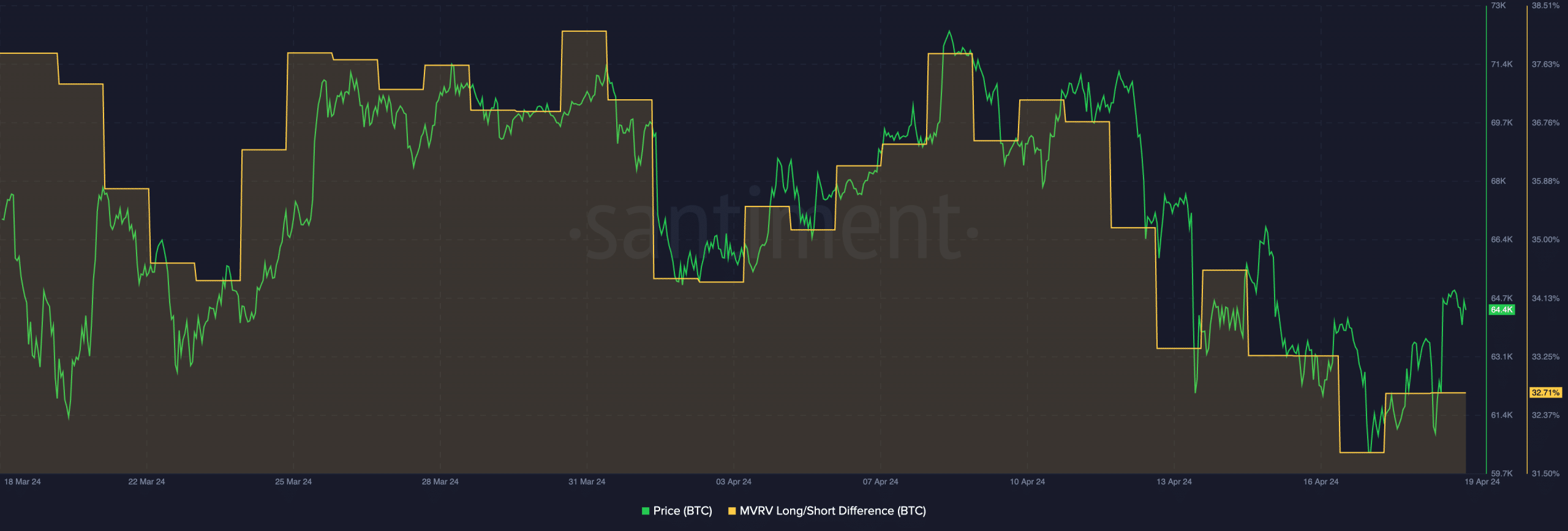

This declining interest in BTC ETFs could indicate that non-crypto-native investors may be losing interest in the king coin. At press time, BTC was trading at $65,965.95 and its price had increased by 1.26%.

Additionally, BTC’s long/short difference had decreased, indicating that the number of long-term holders of BTC has decreased.

Source: Santiment

Learn Crypto Trading, Yield Farms, Income strategies and more at CrytoAnswers

https://nov.link/cryptoanswers

Comments are closed.