- Bitcoin is up more than 4% in the last 24 hours.

- Some technical indicators and metrics looked bearish.

Bitcoin [BTC] has regained its uptrend in the last few hours as the value of the king coin crossed the $70,000 mark after falling below $66,000.

Meanwhile, long-term BTC investors managed to take some profits during the recent price surge.

Bitcoin hits $70,000

Accordingly CoinMarketCap, BTC is up 3% in the last seven days. In fact, its value has increased by over 4% in the last 24 hours.

At the time of writing, BTC was trading at $70,310.91, with a market cap of over $1.38 trillion.

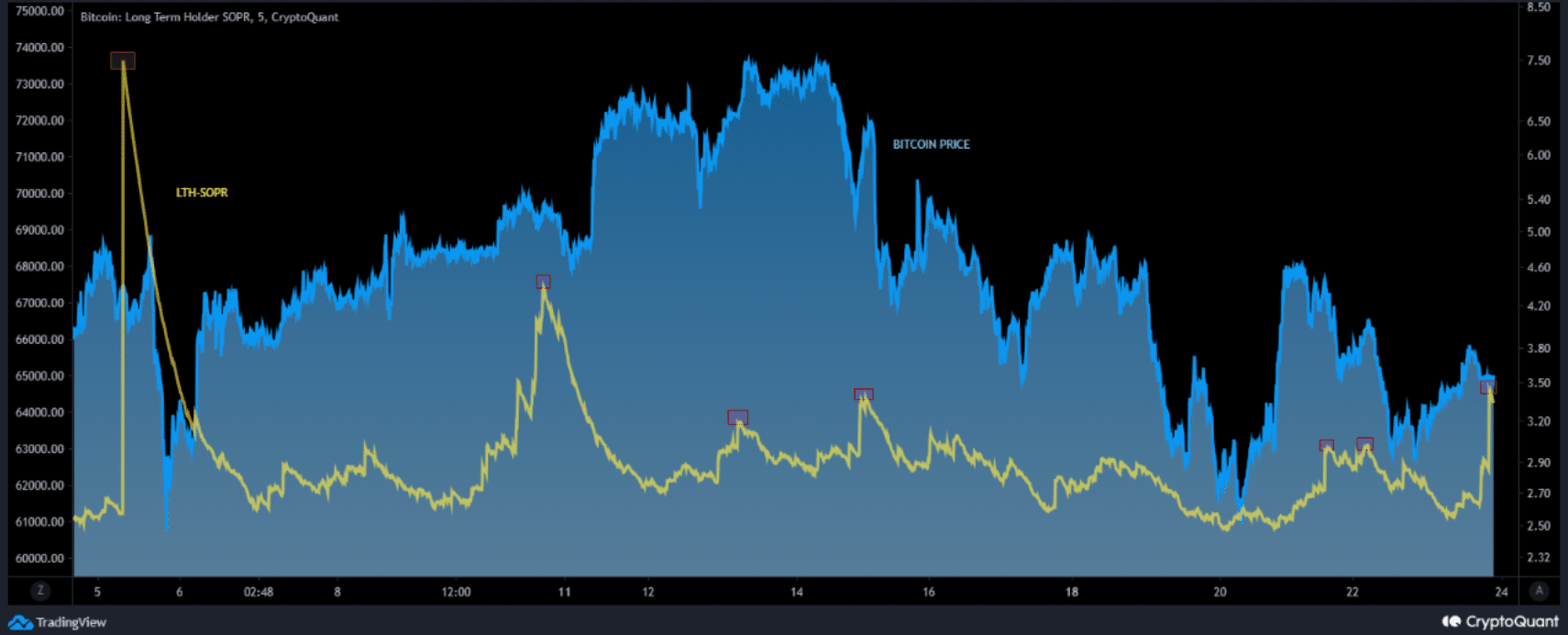

As the coin's price rose, SimonaD, author and analyst at CryptoQuant, published one analysis Highlighting long-term investor actions.

According to the analysis, the Long-Term Holder Spent Output Profit Ratio is a crucial metric for analyzing market trends and investor behavior, especially for long-term investors.

The analysis chart showed that Bitcoin long-term holder SOPR (EMA 144) continued to record spikes since the beginning of March.

This means that investors took some profits along the way as the price reached new highs.

Source: CryptoQuat

In fact, according to the latest data, long-term holders continued to be more active. AMBCryptos analysis by CryptoQuant Data revealed that BTC’s binary CDD was red.

This meant that the movements of long-term holders were above average over the last seven days. If they have been moved for the purpose of selling, this can have a negative impact.

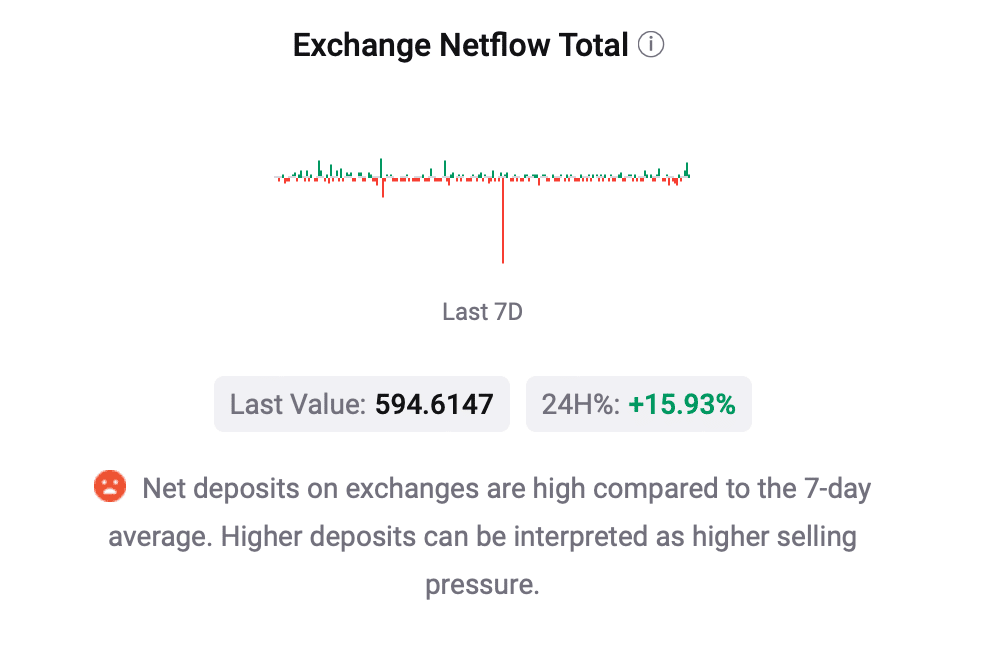

Additionally, the general selling sentiment seemed to have dominated the market as net deposits of BTC on exchanges were high compared to the last seven-day average, which could soon lead to a price correction.

Source: CryptoQuant

Which direction is BTC heading?

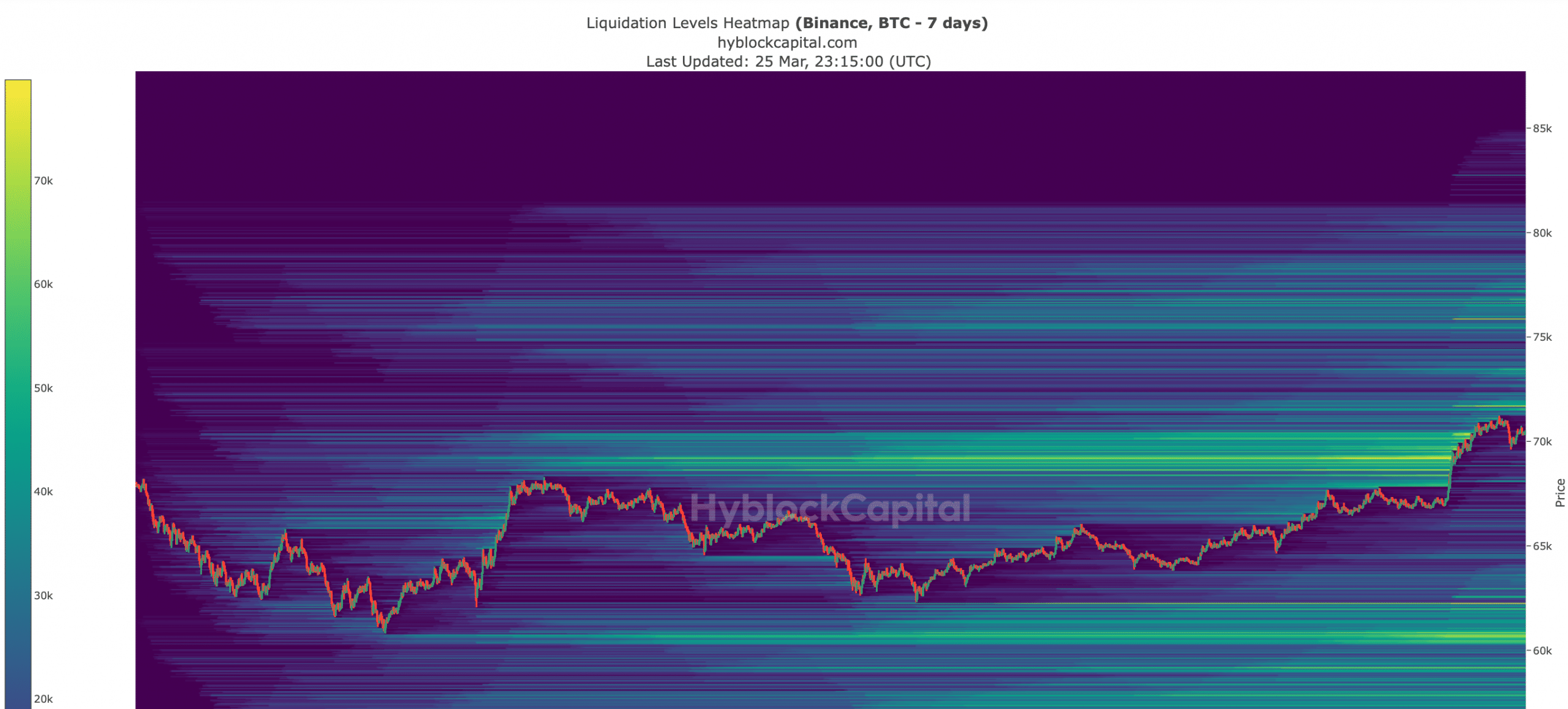

AMBCrypto's analysis of Hyblock Capital's data revealed that a significant amount of BTC could be liquidated if its value reaches the $71,750 mark.

As liquidations will increase, this level could represent resistance for BTC, which could lead to a short-term price decline.

Source: Hyblock Capital

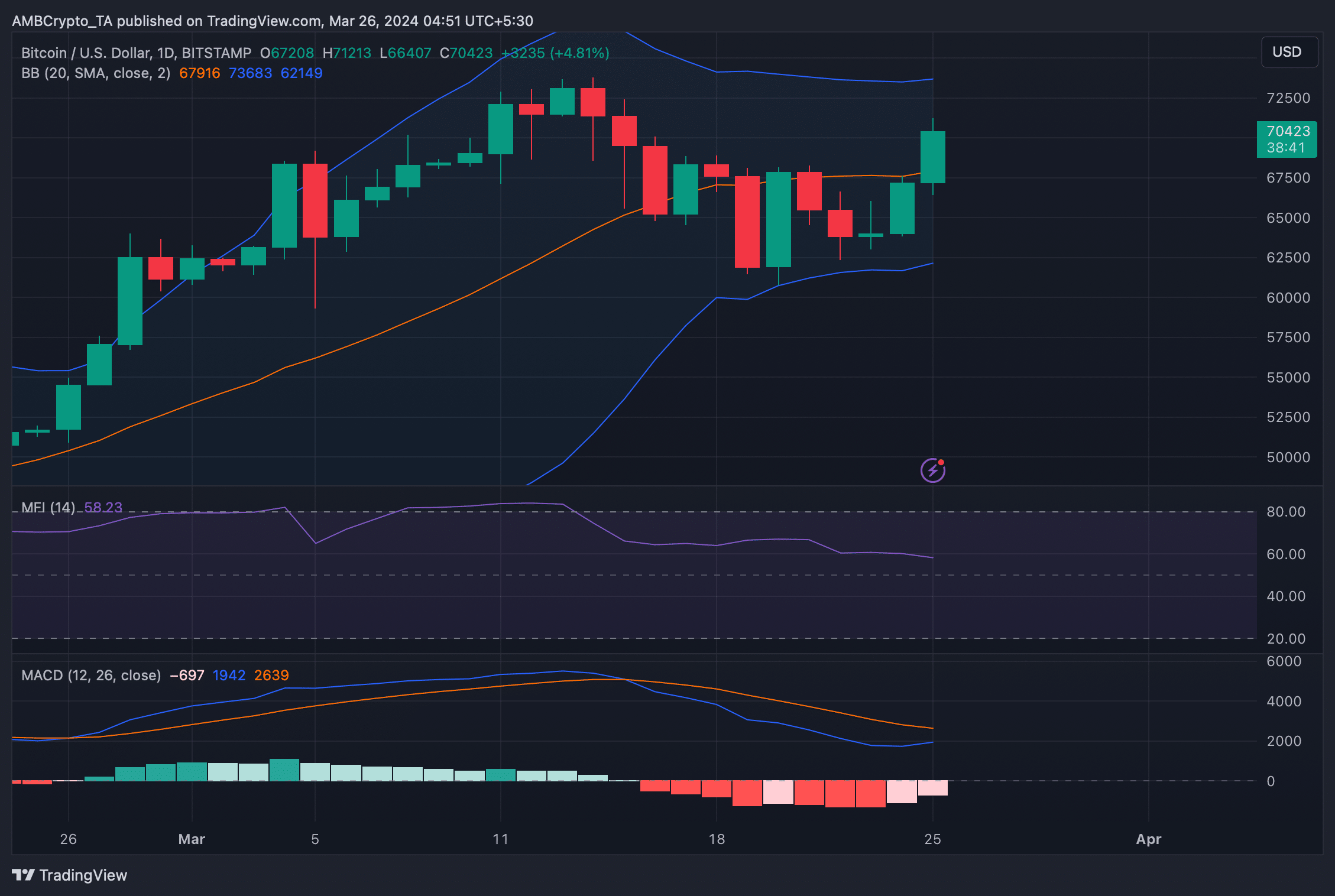

To better understand which direction BTC was heading, AMBCrypto then checked its daily chart. According to our analysis, BTC price rose above its 20-day SMA, which is indicated by the Bollinger Bands.

To read Bitcoins [BTC] Price prediction 2024-25

The MACD technical indicator also suggested the possibility of a bullish crossover in the coming days.

These indicators suggest that BTC is preparing for another bull rally. Nevertheless, BTC's growth momentum may be waning as the Money Flow Index (MFI) has been moving sideways in the past few days.

Source: TradingView

Learn Crypto Trading, Yield Farms, Income strategies and more at CrytoAnswers

https://nov.link/cryptoanswers

Comments are closed.